zero beta portfolio|The Power of a Zero Beta Portfolio: A Comprehensive Guide : Tuguegarao Ene 19, 2024 — A zero beta portfolio is constructed by carefully selecting assets that have a beta of zero. These assets are typically those that are not influenced by the broader market, such . Pinay scandal. Newest. Newest Best Most viewed Longest Random. Satisfied si Pare ng kainin ang Bitlog. Pakantot ang anak ni Tita. Pinatungan Ni Maiza Ang Utog kong Batuta. Dinilaan At Dinaliri Bago Pasukan Ang Puki ni Anne. Pasimpleng Kinalikot ang Tipsy niyang workmate. Sa Abandonanog Building tiinira si Mabel.

zero beta portfolio,Hul 12, 2023 — What Is Zero-Beta Portfolio? A zero-beta portfolio, also known as a market-neutral portfolio, is a investment strategy designed to eliminate systematic risk by maintaining a beta of zero. Beta measures the sensitivity of .To forge a zero-beta portfolio, one combines positively beta-ed assets with those of negative or low beta values, a strategy akin to delta-neutral option strategies. The aim is to balance the .What Does Zero-Beta Portfolio Mean? Investors with a very low-risk tolerance need to minimize investment risks as much as possible. The Zero-Beta Portfolio is created in such a way that .Ene 19, 2024 — A zero beta portfolio is constructed by carefully selecting assets that have a beta of zero. These assets are typically those that are not influenced by the broader market, such .

Ago 22, 2024 — A zero beta portfolio is structured to have a beta of zero, meaning its performance is uncorrelated with that of the market. This concept is rooted in the Capital Asset Pricing .

A zero-beta portfolio is a portfolio constructed to have zero systematic risk or, in other words, a beta of zero. A zero-beta portfolio would have the same expected return as the risk-free rate.Peb 20, 2024 — What is a Zero-Beta Portfolio? A zero-beta portfolio, as the name suggests, is a portfolio that has a beta value of zero. Beta measures the sensitivity of a stock or a portfolio’s .zero beta portfolio The Power of a Zero Beta Portfolio: A Comprehensive GuideZero-beta portfolio. A portfolio constructed to have zero systematic risk, that is, having a beta of zero.Mar 15, 2024 — A zero-beta portfolio is strategically designed to eliminate systematic risk, boasting a beta of zero. This implies that the portfolio’s expected return aligns with the risk .Ene 19, 2024 — Simply put, a zero beta portfolio is a portfolio that has zero correlation to the overall market. This means that regardless of how the market moves, the value of a zero beta portfolio remains constant. Defining a Zero Beta Portfolio. A zero beta portfolio is constructed by carefully selecting assets that have a beta of zero.Ene 3, 2017 — In this situation the zero beta portfolio plays a role similar (but not exactly the same) as the risk free asset if the risk free asset existed. Share. Improve this answer. Follow answered Jan 2, 2017 at 18:28. Alex C Alex C. 9,382 1 1 gold badge 22 22 silver badges 34 34 bronze badges $\endgroup$ 0.An investment portfolio that has zero beta is one that has zero systematic risk i.e. has no market risk – so doesn’t move with the market, either positively or inversely. It can be a portfolio constituted by a portfolio of risky securities that have zero covariance with the market. Such a portfolio can not be expected to return more than the risk-free rate.

Ene 1, 2023 — Footnote 1 The risky zero-beta portfolio rate is greater than the riskless rate, or \(E({R}_{Z})>R_f\). The investor can buy (go long) at the riskless rate and an efficient portfolio. The optimal efficient portfolio in this case is the portfolio T at the tangent point to .May 18, 2024 — Zero Beta. A stock or portfolio can also have a beta of zero, which means it’s uncorrelated with the market. Some hedge funds seek a market-neutral strategy. Being market-neutral means attempting to perform completely indifferent to how .

Set 16, 2023 — Estoque 1: tem um beta de 0,95. Estoque 2: tem um beta de 0,55. Bond 1: tem um beta de 0,2. Bond 2: tem um beta de -0,5. Commodity 1: tem um beta de -0,8. Se o gestor de investimentos alocasse capital da seguinte forma, ele criaria uma carteira com beta de aproximadamente zero: Estoque 1: US$ 700.000 (14% do portfólio; um beta ponderado de .

一种证券之间协方差为零的证券组合。这种证券组合是由F.伯莱克(F.BLACK)在K.L.赫斯特(K.L.HASTIE)的零贝塔正方差证券组合的概念基础上提出的,所以,人们也称其为伯莱克零贝塔资产组合。它假设零贝塔证券组合的协方差与市场证券组合的协方差完全不相关,从而它们之间的协方差也等于零。

Set 24, 2023 — If the beta on a portfolio is 0.5, the portfolio is anticipated to be half as volatile as the broader market. If the stock market (S&P 500) were to rise by 10.0%, the portfolio should expect to increase in value by 5.0%. Gold is a commodity that moves in an inverse direction to the stock market, i.e. with a negative beta.

Risk Control: A zero-beta portfolio is a powerful tool for managing investment risk. Its design focuses on reducing market volatility exposure, yielding more predictable and stable performance than market-linked portfolios. Diversification Gains: Building a zero-beta portfolio requires broad diversification across different asset classes and .

Hul 11, 2024 — Beta Values . Beta Equal to 1: A stock with a beta of 1.0 means its price activity correlates with the market. Adding a stock to a portfolio with a beta of 1.0 doesn’t add any risk to the .Nob 5, 2015 — Click to enlarge. Issues With 22.9% SPY/77.1% TLT Portfolio. Two issues with the zero-beta SPY/TLT portfolio come to mind: Actual beta changes over time, because TLT's beta changes.

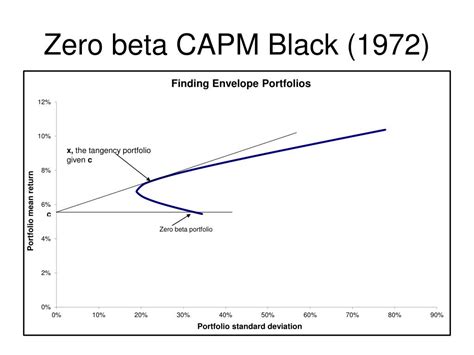

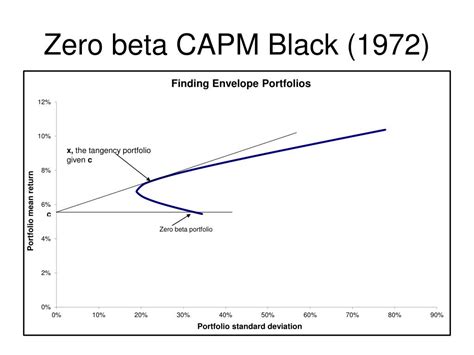

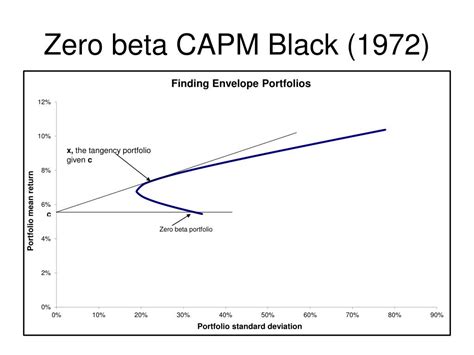

use a zero-beta portfolio, i.e. a portfolio of risky assets with zero covariance with the market portfolio. According to the Black (1972) zero-beta CAPM the expected return on risky asset i is given by: ER ER ER ERiizzm β =+ − where ER z is the expected return on the zero-beta portfolio Z: Portfolio Z is defined as the portfolioOkt 18, 2020 — How Does a Zero Beta Portfolio Work? The investments comprised in a zero-beta portfolio are chosen in such a way that the portfolio's value does not fluctuate as a result of market movements. In other words, a zero-beta portfolio eliminates systematic risk.. Why Does a Zero Beta Portfolio Matter? The absence of systematic risk in a zero-beta portfolio .Hun 21, 2023 — For example, a portfolio with a beta less than 1.0 will typically perform close to market performance. Note: While negative betas are not unheard of they are uncommon and suggest that the portfolio will react the opposite of the market. . Total portfolio beta: Highlighted in row 12 (shown below) is the total portfolio beta is performed also .

zero beta portfolioDis 1, 1975 — The minimum variance zero-beta portfolio z The composition of portfolio z seems to have been established some time ago. Black, Jensen and Scholes (1972, p. 114) chose not to use the knowledge to estimate z directly. Long (1971) derives z in two ways. Let there be N assets in the market. Let superscripts t represent transposes of column vectors.

Abr 15, 2024 — Zero-Beta-Portfolios, auch als marktneutrale Portfolios bekannt, haben aufgrund ihrer einzigartigen Eigenschaften und potenziellen Vorteile in der Finanzwelt große Aufmerksamkeit erregt. Diese Portfolios sind so konzipiert, dass sie einen Beta-Koeffizienten von Null haben, was bedeutet, dass sie nicht von allgemeinen Marktbewegungen .A zero-beta portfolio is a portfolio constructed to have zero systematic risk or, in other words, a beta of zero. A zero-beta portfolio would have the same expected return as the risk-free rate.Such a portfolio would have zero correlation with market movements, given that its expected return equals the risk-free rate or a relatively low rate of return compared to higher-beta .Hul 26, 2009 — Interpreting Beta is rather simple. 1.0 is the Rubicon so to speak. Betas lower than 1.0 indicate that the stock in question has a lower level of systematic risk than the ‘market’ while a Beta .

zero beta portfolio|The Power of a Zero Beta Portfolio: A Comprehensive Guide

PH0 · Zero

PH1 · What is the Zero Beta Portfolio? A Comprehensive Guide

PH2 · What is Zero Beta Portfolio: Definition and Features

PH3 · The Power of a Zero Beta Portfolio: A Comprehensive Guide